The State of the Natural Products Industry in a Digital World (2020)

Take a walk down the aisles of your local supermarket, and you’ll notice things look significantly different than they did even five years ago. The dairy section is now wrestling with a growing selection of dairy-free options, from soy and almond to cashew and oat. Products boast non-GMO, organic, and gluten-free like never before. The vitamins and supplements section gives shoppers a plethora of choices, satisfying a wide demographic of preferences through clear, transparent labeling.At the same time, more people are doing their shopping and product research online than ever before. In fact, online sales of CPG products in the U.S. hit $58.6 billion in 2018, while 82% of shoppers visit Amazon first for price comparisons. This even happens when customers are browsing the aisles of their local market — eMarketer claims that two-thirds look up product information on their smartphones while shopping in-store. Despite this, operating in the natural products space is not all sunshine and rainbows. The industry faces a host of distinct challenges and opportunities regarding digital disruption, presenting brands with their own unique, contrasting, and often surprising e-commerce landscape.

Know Your Audience

Natural products customers are smart, savvy, and passionate about their purchase decisions. Slice Intelligence found that the vitamin and supplement category is growing online 12% faster than e-commerce overall, and is up 40% in the last year alone. And while many natural products brands put heavy focus on their DTC operations, the Amazon marketplace has a stronghold on the industry, commanding around 40% of all online sales in the category. Although online sales are certainly a big deal, the influence of e-commerce expands well beyond the computer screen, as natural products shoppers are masters of cross-referencing. Reports show that 82% of smartphone users check their phones before buying something in-store, while 45% read reviews while they’re at it. Natural products shoppers might be influenced by what’s in vogue, but it’s important to distinguish between trends and fundamental industry shifts. Each year, publications identify top trends from the major natural products trade shows, like Works Design Group looking at trends from Expo East last September. Their blog post identified recurring themes in the industry, like the perception of dairy, sustainable packaging, and CBD. However, the increased desire for transparent labels, for instance, isn’t going to vanish in the next couple of years. The same is true for certain dietary shifts such as veganism, which increased by an estimated 600% in the US between 2014 and 2017. Plant-based diets have even been described by Nestlé, the largest food company in the world, as “a trend that we believe is here to stay and amplify.” Brands can benefit in the short term from jumping on the most recent natural products fads, but will find longevity by identifying and gravitating toward larger shifts in consumer preferences.

The Rise of Digitally Native Brands

Food and beverage is Amazon’s fastest-growing category — up 40.1% in 2018. As with many booming industries, everyone wants a piece of the pie — including brand new, e-commerce savvy startups. New Hope Network found that over half of new brands in the natural products space launched online, taking advantage of low barriers to entry and rapidly growing channels.“Digitally native brands, ones that were born online, grew up quickly and are now thriving — are adept at maximizing all aspects of the platform, and you’ll be competing with a lot more of them too,” says Raj Sapru, Chief Operations Officer at Netrush. “Your new competitors are savvy about imagery, content, digital marketing tools, e-commerce packaging, and how digital consumers shop — and are appropriately resourcing these digital tools for the marketing fight ahead.”In recent years, many digitally native brands have been heavily focused on DTC, including big names like Casper mattresses, Glossier skincare products, and Warby Parker eyeglasses. As far as natural products go, let’s take a closer look at Ritual, a transparency-driven vitamin company. The company is so committed to transparency that their product is clear — literally, you can see right inside of each vitamin. This approach requires very different strategies, including aggressive marketing, to attract customers. But when you search for “ritual vitamins” on Amazon, all you’ll see is a slew of competitors bidding for space.

Private Labels

The advantage digitally native brands have is their expertise and laser focus on e-commerce — and nobody knows the digital landscape better than Amazon. With hundreds of private label and Amazon exclusive brands, the retail giant has put an incredible amount of focus into building their private label and exclusive business, with a current emphasis on apparel and CPG products. With endless troves of consumer data paired with a seemingly bottomless budget for experimentation, Amazon is able to appeal to the psyche of shoppers while making calculated financial risks.Amazon Elements, for example, sells vitamins and supplements that aggressively appeal to consumer preferences in the natural products space. Their supplements “use only pure organic ingredients” and share “the whole story” of the product, including all ingredients, date of manufacture, the lab where the product was tested, purity levels, production process, and much more. It’s no joke — just look at the lab test results on this Amazon Elements B12 listing. The “Editorial recommendations” section on a search for B12 even lists Amazon Elements B12 as the “Most Transparent” option available. While private label and exclusive brands should be seen as a competitor, Amazon claims that their private label brands only account for 1% of their sales, which is significantly lower than other retailers.

How Brands Can Compete

According to Nielsen, private labels accrued $143 billion in sales in 2019. That’s an increase of $14 billion from 2015 and an intimidating trend for brands. However, as we can see from the numbers (and the success of digitally native offerings), brands still matter. Branded products amassed $671 billion in sales in 2019, which is a $27 billion increase from 2015. Shoppers may be more open to private labels, but they will still pay for a brand they’re familiar with and trust. To maintain an edge against private labels, brands need to look for new ways to innovate and distinguish themselves as a more premium option — by taking a page out of the digitally native brands’ playbook.

Rise to Their Level, and Then Some

Shoppers generally choose private label brands because they’re inexpensive and from a trusted retailer — but not usually because of their superb quality or reputation. While Amazon Elements offers quality and transparency that might satisfy the average consumer, some brands go above and beyond.MegaFood, a whole food supplement brand, is an example of a brand doing this well. The company is constantly livestreaming their production process to assure 100% trust from their customers and has advanced transparency initiatives in place.Natural Factors takes a somewhat different approach — the supplement brand leverages their uniquely integrated supply chain, in which they own their own farms, facilities, and testing labs, in order to deliver quality and trust to their customers. It’s hard for a startup, tech-savvy brand to compete with that — let alone a private label.

Balance Industry Experience

Brands that have been around the block a few times tend to know more about their customers and the industry than their startup competitors. This can be both an advantage and a disadvantage — while mature brands are able to harness their veteran knowledge to appeal to their audiences more effectively, some don’t adapt to changing markets or utilize modern digital resources, and suffer from stagnation as a result. Startups are more likely to be bold, take risks, and focus on specific market opportunities, and as a result, will sometimes come out ahead. It’s important for brands to strike a balance between experience and the willingness to adapt and innovate.

Digital Shelf

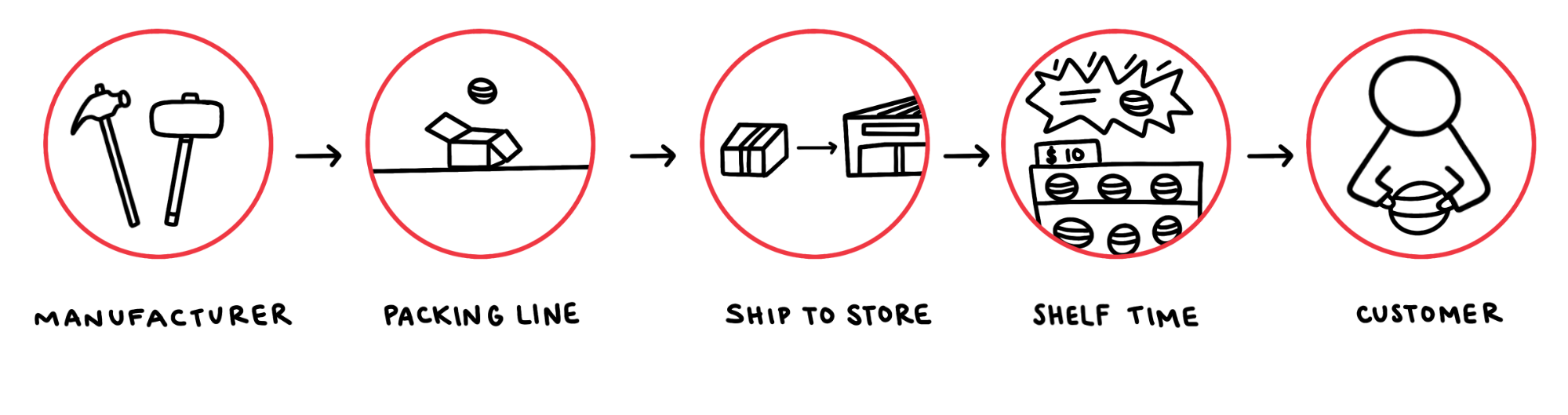

Traditional brands designed products to sit on a store shelf, paying close attention to what product sizes and packaging designs turned into sales. The digital shelf, along with its consumer touchpoints, are entirely different.

Brick and Mortar Touchpoints

E-commerce touchpoints

Natural products brands have a lot to gain by using Amazon to learn about their customers. Your company’s data on top selling products, best sizes, and ideal packaging design for brick and mortar can blind decision-making when operating on Amazon. In the same way that digitally native brands would initially struggle if asked to sell products on a shelf, traditional brands have a lot to learn from their tech-savvy counterparts.For example, some bright, flashy packaging may work great at making sales in-store, but that role is replaced by compelling content — photos, videos, and graphics — on Amazon. “Netrush has gotten feedback from customers saying that — even when the presentation looks great — it’s the process of opening the package and getting to the product that affects their overall experience,” says Colby Grantz, Packaging Director at Netrush. “A bad unboxing experience could cause a customer to not buy from you again. It’s better to invest in minimal, easy-to-open packaging that customers won’t remember than to brand oversized, difficult-to-open packaging that’ll be negatively remembered.”

Tell Your Story

Private label brands simply make carbon copies of original products — without a market leader, no alternatives can exist. As a result, they don’t have a story, don’t have a founder, and are ultimately void of personality. Digitally native brands are the polar opposite — they tout uniqueness as their core competitive advantage. As consumers become more conscious of their dollar votes, brands born out of necessity, rather than to simply sell products, can leverage their unique upbringings in order to gain trust from their core customer base.

Regulations

The world of consumables, particularly natural products, revolves around changing and evolving regulations. FDA Commissioner Scott Gottlieb has recently made statements regarding reviewing the standards of product claims, such as labeling a product as “organic” or “non-GMO.” There’s heated debate, for example, around the use of the word “milk” and whether or not it can be used for products like almond and oat milk. More importantly, regulations seem to be leaning toward requiring specific health claims on labels to be quantified, or removed altogether. Nature Valley was even forced to drop the phrase “100% natural” from its packaging after a legal battle.With all this uncertainty, brands face an upcoming challenge, and have already felt the pressure to reimagine how they present themselves.

Moving Forward

The natural products industry, while presenting brands with unique challenges, is ultimately a space filled with innovation and opportunity. As consumer preferences shift and interest in natural products increases, brands can take advantage of the industry’s growth by focusing on their roots, leveraging their creativity, and making investments in the rapidly-growing world of digital commerce.